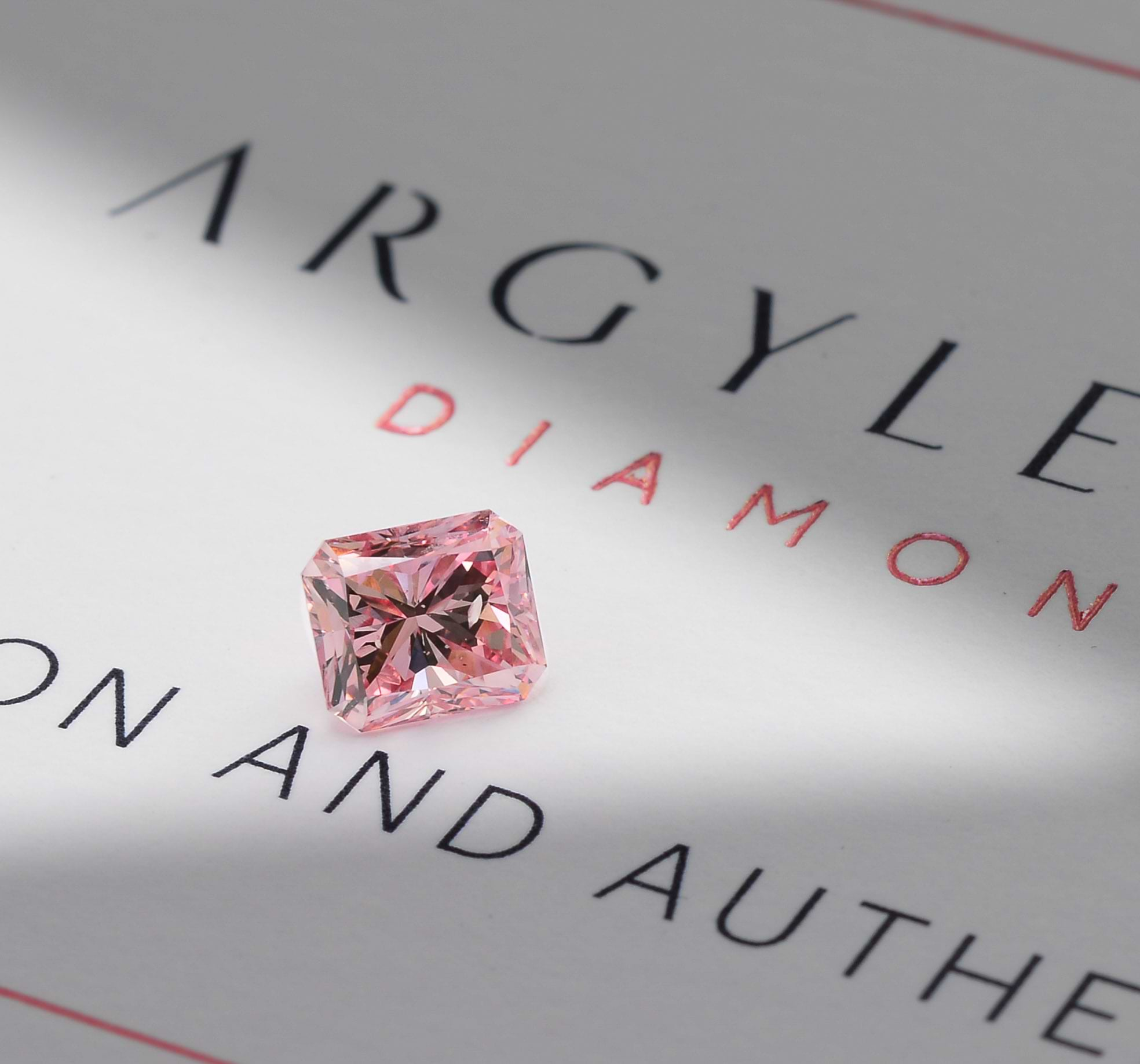

Argyle has become synonymous to pink diamonds the same way DeBeers is for colorless diamonds.

Rio Tinto, the owner of the Argyle mine in Kimberley, Western Australia, has done a fantastic job promoting its diamonds, claiming that they control 90% of all pink diamonds worldwide - the same way that DeBeers had controlled colorless diamonds up to the mid 90’s.

The Annual Argyle Tender

It seems that last week was a hot week for major fancy color diamond announcements, between the Blue Moon from Cora International, the De Beers Purple Pink diamond, and Argyle's release of the 2014 tender stones – quite exciting!

Just to help conceptualize how important the tender is and the stones sold, remember the following: for every 1 MILLION carats that are extracted from the Argyle mine, only ONE carat gets to be included in the tender.

Overall Impression

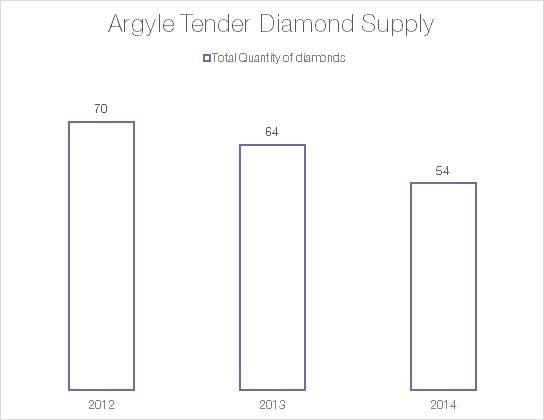

My overall impression is that quality diamonds are once again available to the market to be tendered away. There are 54 stones available, totaling a carat weight of 46.88 carats (just think about how many carats had to be mined to get to this number!). The Argyle mine is attempting to make this tender as special as possible, considering that it is the 30th anniversary of the tender process to be conducted by Rio Tinto since 1984. The marketing efforts by Argyle have realized amazing results, by the continuous increase in value of their diamonds. Argyle does not officially publish the results of the tender, but based on market prices paid for them we are able to see firsthand the value that these stones have been able to garner and retain in the last 30 years. Going back in time and seeing what prices were paid just 5-10 years ago in comparison to today, we can get a good laugh, wishing we can get our hands on them at those prices.

A Year Over Year Comparison

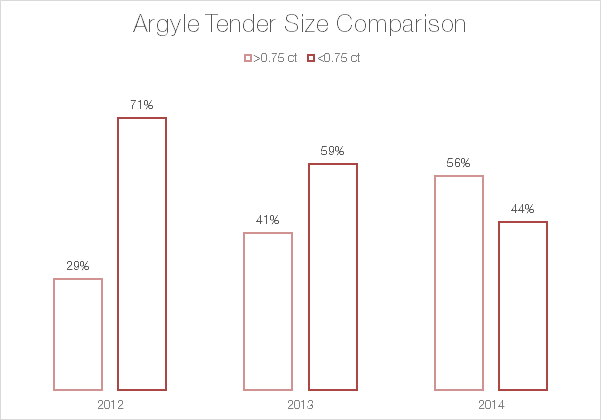

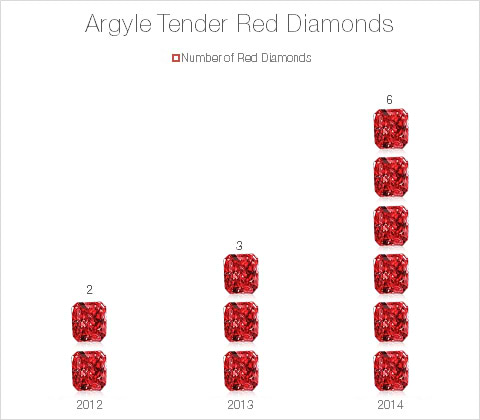

When further analyzing the stones this year compared to last year, we can see clear cut differences. This year, there are only 54 stones compared to the 64 of last year, a drop of over 15%. If this is because the supply is tight, it can mean that prices will be higher this year. Another clear indication of difference between the years is the diamonds’ size. It is quite clear that this year there are bigger stones being offered. 56% of the stones this year are larger than 0.75 carats, compared to only 41% larger than 0.75 carats last year. In terms of diamond clarity, both last year and this year have diamonds of pretty much the same levels of clarity. At first glance, it seems that the diamonds’ clarity is better this year, but if we were to remove the 10 stones from last year, it would be as equally good. The other major positive indication is that there are 6 (4+2) red diamonds, compared to only 3 last year. This in no way tells us that red is any less rare this year than it was last year. Finally, this year there are no blue diamonds at all in the tender, compared to 3 last year, and 14 back in 2012.

Bigger stones have increased in quantity over the last 3 years

Trend is not yet set, monitoring for next 2-3 years needed to establish

Ability to better improve polishing does not indicate that there are more diamonds available

Open vs. Underground Mine

During 2013, the Argyle diamond mine officially became an underground mine. Until then, it was an open pit mine. Transforming into an underground mine means that the cost of extracting these diamonds became more expensive and more dangerous. In turn, this translates into higher prices. Last year was actually the first time that Argyle has even vaguely indicated where its prices stand. They apparently had the most ever bids over $1 million per carat than any other tender before, and had the highest price ever paid for an argyle diamond for the Argyle Phoenix.

By the decrease in diamonds available in the tender we can deduce that either supply is tighter, or that Argyle is attempting to control supply in order to extract higher prices. In my opinion, neither is true. We simply have to look at the secondary market for Argyle diamonds and see the behavior over there. Being in the market as both a seller and as a facilitator of transferring diamonds between sellers and buyers, we have rarely seen Argyle diamonds hit the market again once they have been sold, meaning that demand is very strong. In fact, it is very rare that you see Argyle diamonds sold at auction at all - I have only seen it done once or twice via the major auction houses Sotheby’s and Christie’s in the last 18 years.

Selection criteria of tender diamonds improved

According to Rio Tinto, the Argyle mine is set to close by 2020, So how will that affect prices?

As we all know, basic economics dictates that the rarer a product, the higher the demand and a subsequent increase occurs in price and perceived value. Unless an alternative mine is found in the next year or two for pink diamonds, we have to take into consideration that by 2020, 90% of world supply of pink diamonds will no longer be available - an automatic increase in value for the remaining 10%.

On the other hand, if the prices of Argyle pink diamonds that are fetched at auctions increase from year to year and yield higher prices for Rio Tinto, it may change its mind and allocate more resources into extracting these highly priced diamonds in order to resume their supply to the market. It could be that Rio Tinto preferred being cautious when announcing the eventual close because it is possible that as the size of their diamonds increase, and their ability to polish them improves, would convince them to further mine there.

Total stones decrease, indicating lower supply

Average Diamond size increases, indicating bigger stones' availability

Conclusion

From analyzing the information from the last 3 years in the graphs, we are able to get an indication that supply is getting tighter due to the decreased amount of tender stones. We can also conclude that the average size diamond extracted has increased, and that Rio Tinto’s polishers have been able to improve their polishing. However, we still need to follow these indications for the next 2-3 years in order to conclude on a trend.

Got any questions about the tender, or any favorite diamonds from what we are offering? Ask away in the comments!