What seems to be the most popular trending asset classes in 2012, demonstrating even better than Gold, color diamonds have shown fantastic price performance and maintain a market demand that has been steadily increasing over the last 30 years.

As one of the most prized possessions on this planet, as a result of their extremely rare colors, certain natural fancy colored diamonds are now considered extremely wise investments pieces. For example, the image below contains small stones, but of all extremely rare colors - therefore significantly increasing the value of each.

|

A collection of Argyle Pink, Blue and Violet Tender diamonds |

Many major financial institutions have already picked up on this trending asset. They have begun alternatively diversifying their client's investment portfolios with a little color and 'bling' to strengthen their long-term chances of high returns. Many finance and diamond institutions have released numerous articles on the subject of investment which present the impressive potential that natural colored diamonds hold.

However, the purpose of this article is not to present more reasons why no one can deny the amazing investment potential color diamonds hold. Rather, we wanted to provide tips on how to go about taking advantage of this trending opportunity and what you need to know!

1. Educate Yourself

Before you pick up the phone and start talking to people, start doing a little research on the subject.

Read up on material and try to understand the basics of color diamond education. Unlike colorless stones, color diamonds are not sold according to a price list. Also, certain attributes can cause prices to vary quite drastically from one to another. There is a lot of material to read and many different points that need to be studied. However, especially today, the information lies at your fingertips and all you need to do is look around.

|

A LEIBISH diamond loupe with a Blue Diamond heart, a Pink Diamond round, and an Orange Diamond oval |

Just as important as understanding the trade, one needs to understanding the asset class for investment opportunities. Sit yourself down for an afternoon of reading on color diamond investments and learn why they have been acknowledged as such powerful investment options.

You need to be sure you are not purchasing a 'pig in a poke.' When it comes to investment diamonds, review the material above and understand in full the world you are entering.

2. Plan Your Budget

If you weren't aware beforehand, after having begun reading up on the subject you will find that there is a large range of color diamonds worth investing in. Since the purpose is to help you define what is best suited for you, decide first what you are prepared to invest.

One of the first questions a diamond consultant will ask is 'what you are prepared to invest.' Someone who is familiar with the market will help direct you towards the perfect stone or stones, but needs to know first in which direction to go. Some prefer to put all their money into a very large and expensive diamond, while others would prefer to build a complete color diamond portfolio.

|

A Pink Diamond placed on English coins, in order to demonstrate the different values |

3. Consult with a Professional

Do the required research and find the professional knowledgeable in the field that you can trust. Especially in a trade with such luxurious items, unfortunately people are taken advantage of all the time! Finding the perfect stones worthy of investment should not be done on your own or overnight. Ask anyone you know who has dealt with diamonds beforehand and utilize the Internet to help find a company you can trust!

Most importantly, don't be shy to ask questions. No diamond dealer assumes that the general public understands the industry like they do. There is a sea of information, but tons of material that help to explain each and every aspect.

|

Leibish Polnauer, president and founder of LEIBISH |

4. Know What to Expect - Liquidating Your Asset

If you are looking for a quick turnaround, investing in color diamond is not for you. Price performance has demonstrated fantastic results over the past 30 years, and even stronger and more impressive since we moved into the 21st century. Still, it is a price growth that increases over time and will not be seen over night.

Color diamonds are unique, so much so that no two colored diamonds are exactly identical. A beautiful stone will not lose its value over time because of inflation into the market, since each one found has its own diamond characteristics that cannot be duplicated. From time to time, there are very similar color diamonds found, and often paired together for color diamond jewelry, but still that only increases their value as they become part of a set.

Certain assets are more difficult to liquidate. However, diamonds were, are, and always will continue to be traded. Developing a relationship with a reputable diamond dealer is critical. A professional within the trade, who can be trusted, will have a much broader crowed to market towards. Furthermore, they will often be happy to help you to sell it for a small percentage, or perhaps even purchase the stone themselves. Over the years, LEIBISH has helped many clients sell their diamonds through contacts in and out of the trade. Next, there is always the option of bringing it to auction. Obviously, along this rout, the rarer the stone the easier it will be to sell. Lastly, there is trying to sell it on your own (social networking, consumer-to-consumer sites like eBay, or uploading it to lists scouted by traders). Similar to selling your house, although you can do it on your own it is often worth investing in a real-estate agent who has more contacts and understands the trade.

5. Investment Diamonds

We can't speak for all companies, but LEIBISH only directs people to specific diamonds worthy to be called investment stones. Some examples of these investment-worthy diamonds are:

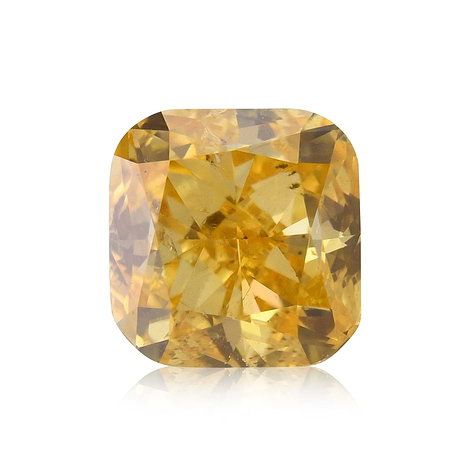

- Fancy Intense or Vivid Yellow Diamonds of a high clarity grade (VS+) above 2.00-carats with Very Good (VG+) Polish/Symmetry/Proportions or above.

The approximate price per carat LEIBISH sold a 2.00-carat Fancy Intense Yellow diamond with a VS+ clarity grade over the past ten years was 10Y=$5,000 , 5Y=$8,250, 4Y=$9,200, 3Y=$10,250, 2Y=$11,000, 1Y=$12,300, Today=$13,500. That is fantastic 170% appreciation!

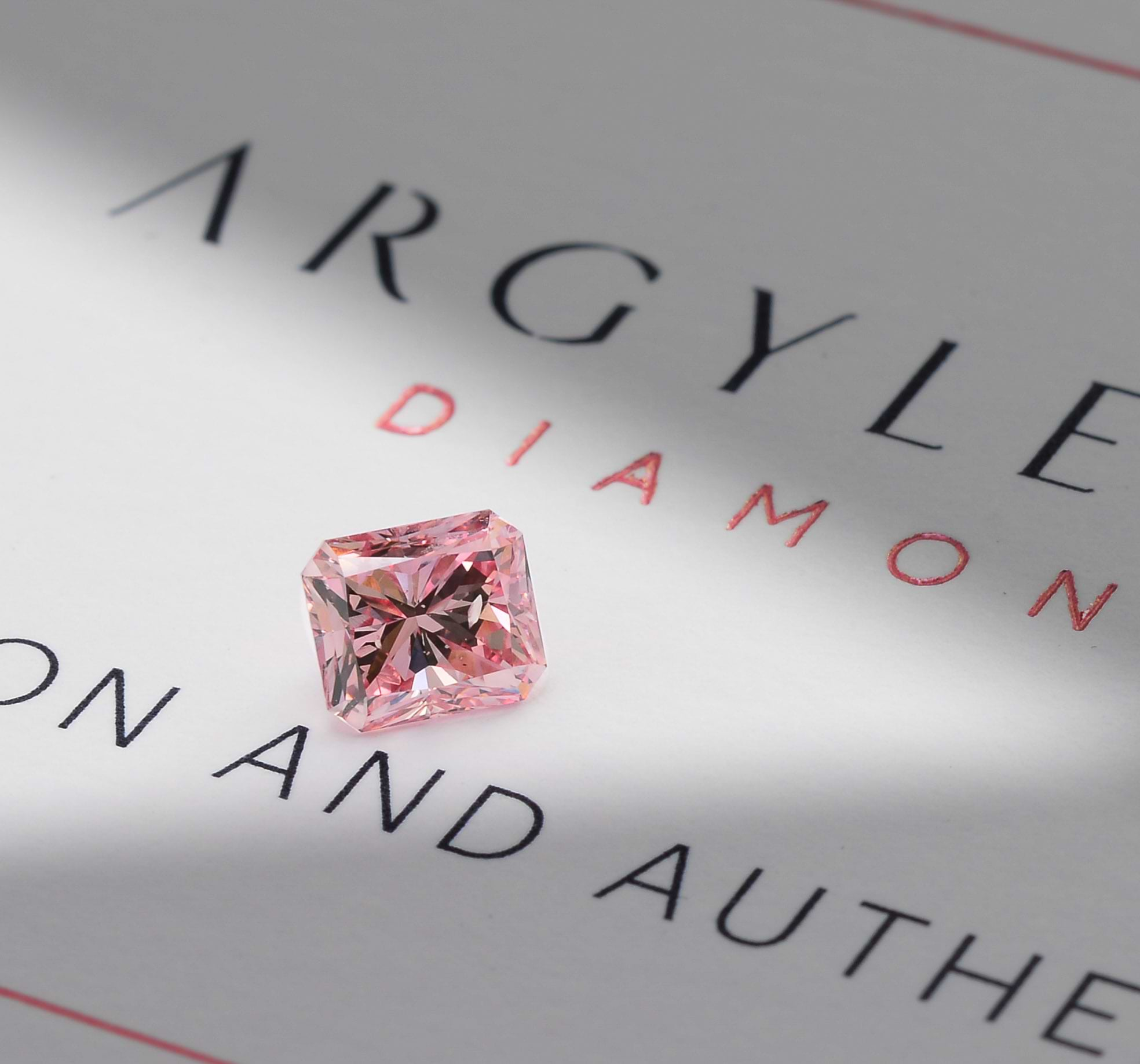

- Argyle Pink Diamonds of any shape with a size above 0.40-carats.

The approximate price per carat LEIBISH sold a 0.50-carat Fancy Intense Pink Argyle diamond over the past ten years was 10Y=$30,500 , 5Y=$50,000, 4Y=$63,000, 3Y=$80,000, 2Y=$90,000, 1Y=$115,000, Today=$145,000. That is fantastic 375.41% appreciation!

Both Yellow and Pink Diamonds in general have a very high market demand. Also, other rare colors like Red and Blue do quite well at public auctions. They will all therefore appreciate regardless since the market recognizes the benefits these stones offer. However, as an investment-worthy diamond, where the long-term appreciation is so significant, these two cases specifically are considered exceptional for their great investment potential.

|

A fantastic collection of Argyle Pink, Blue and Violet diamonds |

No one can predict the future, but the ability to analyze the information available and assess which asset class should be considered a wise investment is there. Call LEIBISH today and allow us to open the conversation of color diamond investments that will for all intents and purposes stand to change your life forever.

Contributor: Benji Margolese