The world economy may be in upheaval but some things continue to sparkle. The rise in diamond prices has continued unabated, notwithstanding increased volatility in stock and commodity markets.

The U.S. still constitutes the largest market for diamonds accounting for approximately 40% of global demand. China and Hong Kong currently represent around 10% of the world market. However, with the U.S. economy undergoing its toughest period since the Great Depression, demand is expected to at best remain steady. Contrast this with the 20-30% growth rate for diamonds in China and Hong Kong each of the last five years.

Even though economically the U.S. is in descent,

the newly wealthy in China and India still admire the U.S. and its culture. Imagine then what would happen to diamond demand and prices if the 21 million couples in China and India who marry every year begin to mimic the U.S. custom of celebrating engagements, marriages and other significant events in their lives with diamonds.

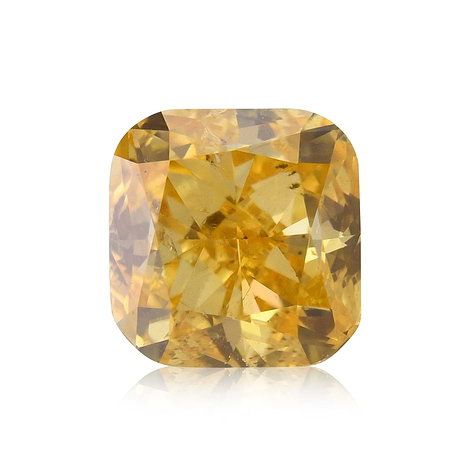

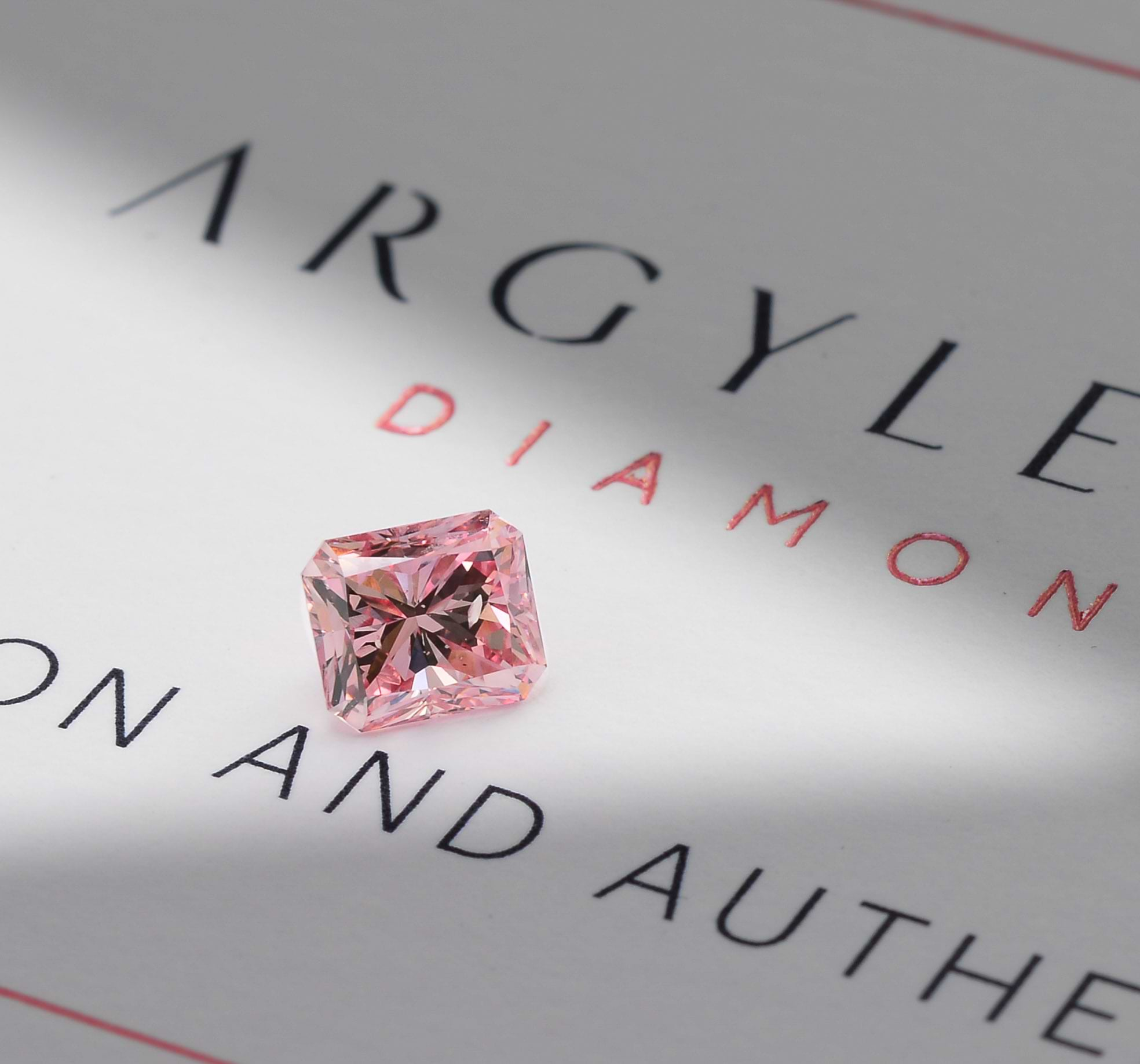

The Chinese upper middle-class consumers in particular are very conscious of acquiring high-end luxury goods – what they perceive to be “the best.” High-end luxury does not come much more exclusive than fancy colored diamonds. Fancy colored diamonds are much rarer than colorless diamonds and can sell for 100 times as much as similar-sized colorless diamonds.

According to De Beers, if, over the next 15 years, the Chinese per capita income increases to the level of Taiwan, and if urban Chinese consumers acquire diamonds per capita at the same rate as the Taiwanese, the diamond industry will need to double its output just to meet demand. The rarity of diamonds in general and fancy colored diamond in particular will appreciate considerably as this unfolds with China and India expected to provide approximately 50% of sales growth in the next five years, according to McKinsey & Co.

To help satiate this anticipated demand, Chinese jewelry chain Chow Tai Fook is planning to open over 1,000 new jewelry stores by 2020, assisted by the proceeds of a planned $2-3 billion IPO in Hong Kong later this year. This is the same company which bought the 507.5 carat Cullinan Heritage rough pink diamond from Petra Diamonds last year for a record USD35.3 million.

De Beers increased the price for rough diamonds by an almost unprecedented 17% in the first three months of 2011. In spite of this rise in prices, sales volumes have remained strong.

As a hedge against the unprecedented money printing in the U.S. and to a lesser extent the European Union, there has been a flight to hard assets. Almost all metals and commodities are at or near all time record prices.

Diamonds are different to most other commodities. Gold is measured in troy ounces, copper in pounds or tons. Diamonds are measured in carats. One carat equals 200 milligrams. One ounce equals 31,103.48 milligrams. Do the sums and you find that the rarity, known resources and limited new supply of diamonds far exceeds that of other commodities. Their transportability and ability to act as a means of exchange in turbulent times are additional factors in their favor.

Growing demand from China and India and limited supply only results in one logical conclusion for the future of diamond prices. When considering that only 1 in every 10,000 diamonds is a fancy colored diamond, price expectations should be even more dramatic.

View our recommended diamonds for investment