An article in the Rob report on April 25, 2014, titled “Why I Broke Up with Warren Buffett”, prompted me to look back at our own archives relating to Warren Buffett. I decided to update our database with a more in depth analysis relating to the performance of fancy color diamonds and the esteemed 'Oracle of Omaha', as he is otherwise known. I was quite surprised at the results, especially after the all of the glorification that Berkshire-Hathaway tends to receive.

If we look back, has an active or a passive investment management style performed better?

Selective Comparison

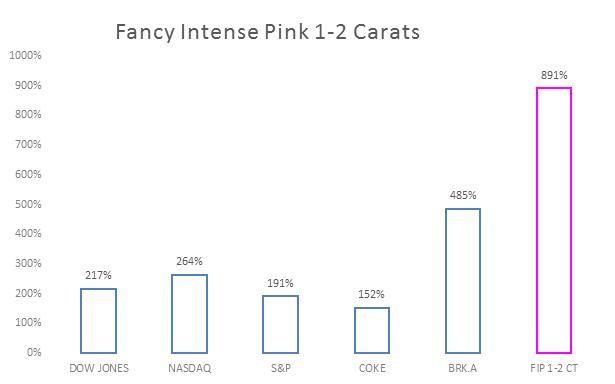

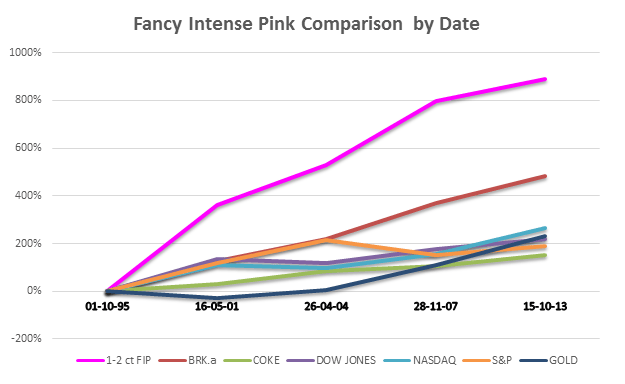

We all know that when a firm, or any other entity, wants to compare its product to its competition, it usually does some sort of selective, subjective comparison. They choose a product or two which significantly lead the competition and then generalize its superiority with some statistical analysis. For argument's sake, in this section I did the same. I chose a small size fancy color diamonds, in the shade of Fancy Intense Pink, from the 1-2 carat category, I gathered independent third party information (Sotheby’s and Christie’s), and I compared it to Berkshire Hathaway stock performance in a time frame to cover the last 16-18 years. As a twist, I even added a famous investment of Berkshire, Coca Cola.

As you can see below, Fancy Intense Pink diamonds, sized between 1 and 2 carats performed significantly better than Berkshire Hathaway, Coke, Dow Jones, Nasdaq, S&P, and Gold between 1995 and 2013. Do you find this hard to believe too? See the data with your own eyes, below!

1-2 Carat Fancy Intense Pink Price per Carat Comparison by Date

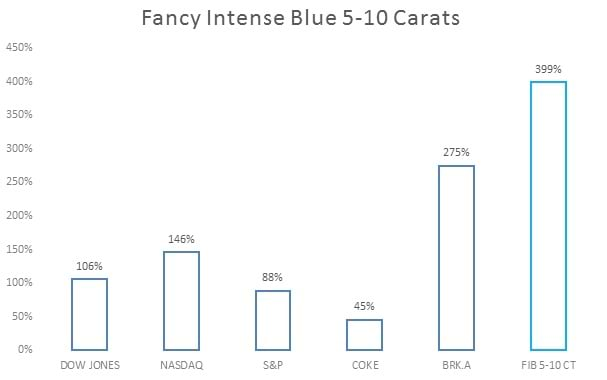

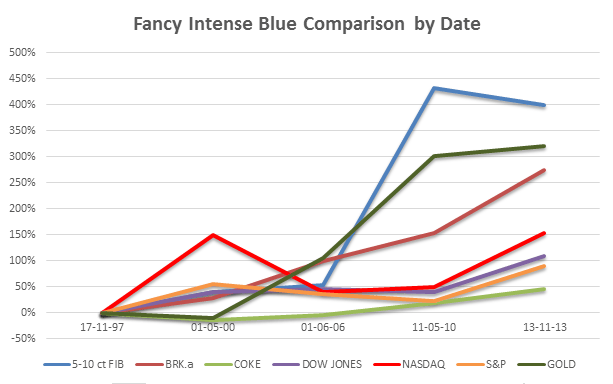

The following graph displays the same statistical analysis as above, only the diamonds used are 5-10 carat, Fancy Intense Blue diamonds. The time frame is between 1997 and 2013 since there were no Blues of this caliber sold at auction between 95-97.

5-10 Carat Fancy Intense Blue Price per Carat Comparison by Date

Broader Comparison

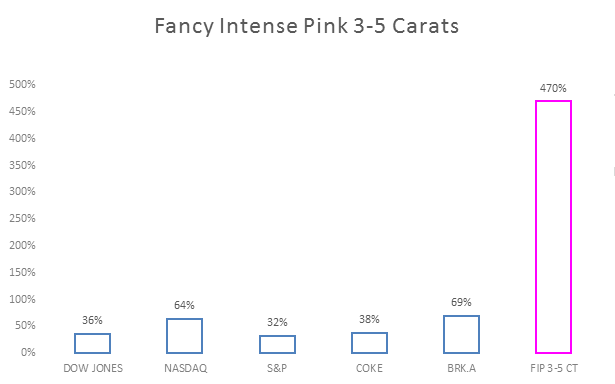

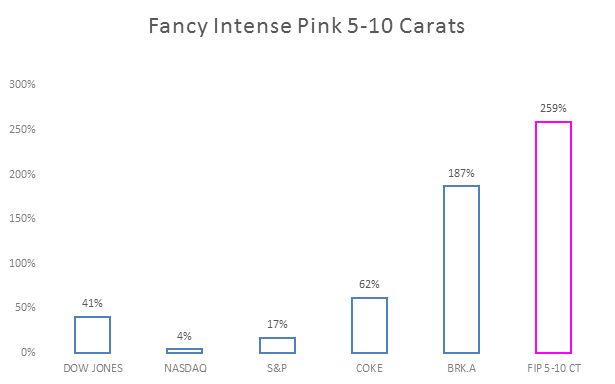

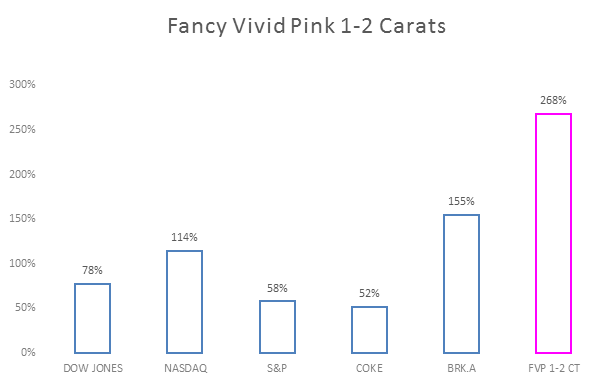

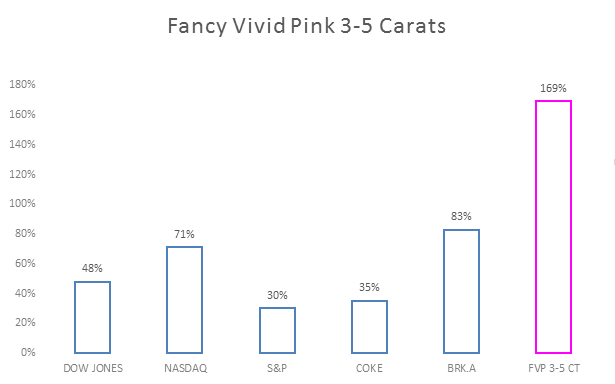

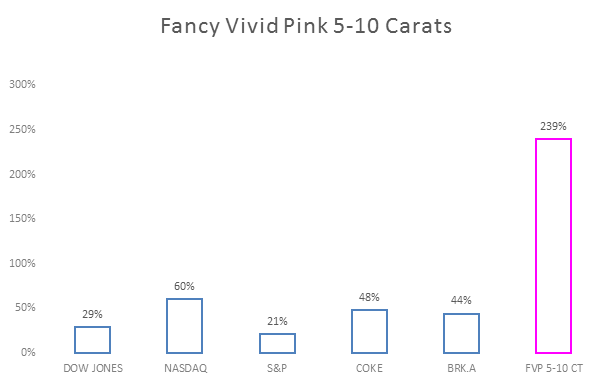

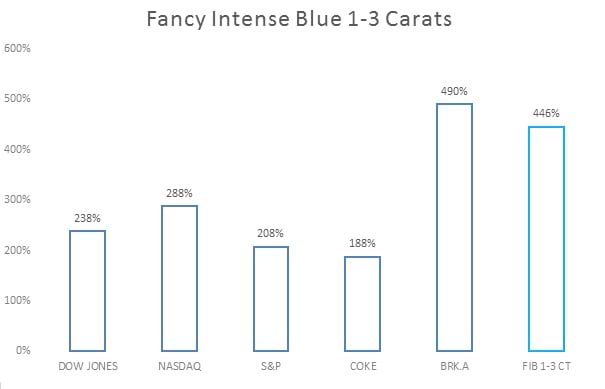

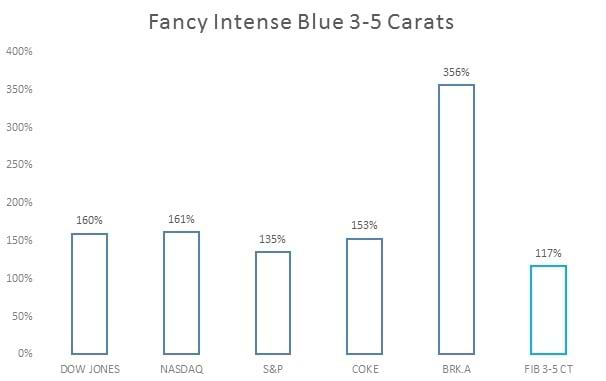

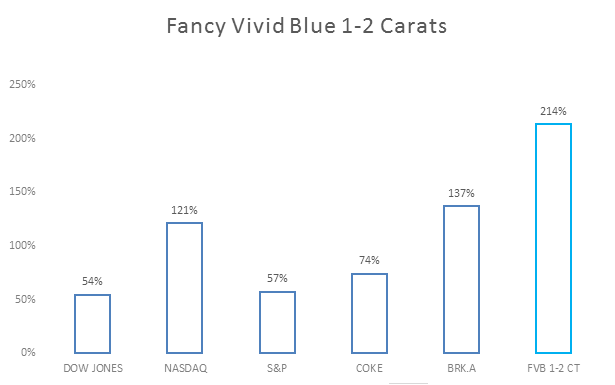

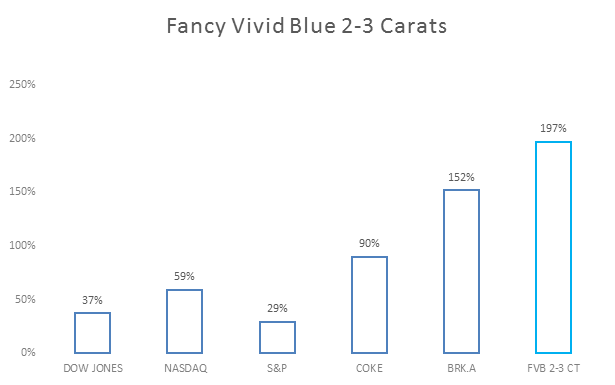

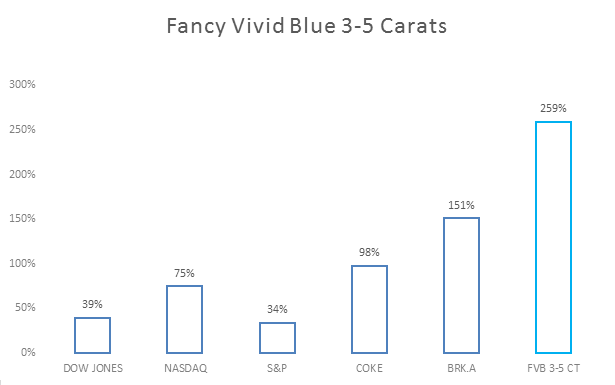

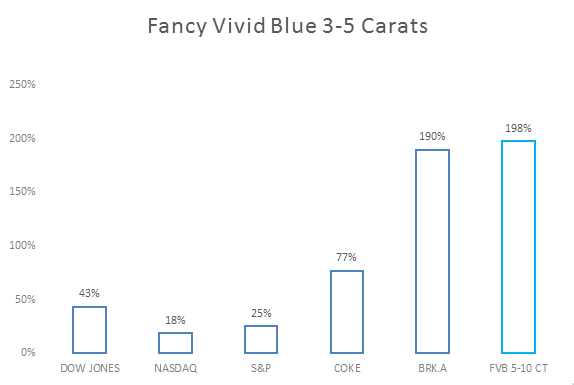

Now that we have shown how fantastic and almost “steroid pumped” these two analyses were, we can focus on the broader Fancy Intense Blue and Fancy Vivid Blue size spectrums as well as Fancy Intense Pink and Fancy Vivid Pink Diamonds size spectrums compared to the same assets as above. In order to make this analysis more clear and comprehensible, I proceeded with dividing both colors; pink and blue, into various subcategories consisting of groups of sizes. For pink, I grouped them into the ranges of 1-2 carat, 3-5 carat, and 5-10 carat. For the blue, I divided them into 1-2 carat, 2-3 carat, 3-5 carat, 5-10 carat, thus creating 13 separate and distinct comparisons.

Comparisons of Various Fancy Color Diamonds to Other Assets

|

OCTOBER 1, 1995 - OCTOBER 15, 2013 |

|

JULY 8, 2003 - MAY 29, 2012 |

|

MAY 17, 2000 - OCTOBER 15, 2013 |

|

APRIL 6, 1998 - NOVEMBER 26, 2013 |

|

APRIL 27, 1998 - APRIL 3, 2012 |

|

MAY 2, 2005 - APRIL 1, 2012 |

|

OCTOBER 23, 1995 - NOVEMBER 26, 2013 |

|

MAY 15, 1996 - APRIL 8, 2013 |

|

NOVEMBER 17, 1997 - NOVEMBER 13, 2013 |

|

FEBRUARY 21, 2002 - OCTOBER 15, 2013 |

|

MAY 17, 2001 - MAY 28, 2013 |

|

MAY 1, 2001 - OCTOBER 15, 2013 |

|

NOVEMBER 18, 1999 - NOVEMBER 13, 2013 |

From the above graphs, we can conclude that Warren Buffett’s strategy of buy and hold for his own stocks works very well for Blue and Pink diamonds over a long period of time as well! Just like Berkshire, we diversify our holdings across the various sizes and colors, which we deem to be of investment grade. As you may have noticed, out of 13 categories, BRK.A has made superior rate of return in only 2 of the 13. On the other hand, COKE has had superior return in only 1 out of 13 categories. Those are staggering numbers in favor of color diamonds! Also, just in case you are wondering, the stock prices and performances of BRK.A and COKE include all stock splits and dividends paid.

Conclusion

In conclusion, I made this analysis for those that keep on wondering whether they should invest in diamonds. The answer is: it depends. Just like any other investment, your decision should be based on objectives, risk tolerance, and time frame. We all know that an investor should be well diversified in various investment sectors, and should consult an investment advisor that can help make a proper decision. Should your investment advisor not be well knowledgeable about investing in diamonds, feel free to have him or her contact us for further information and assistance!

* This is a follow up to the article Lunch With Warren Buffett.

Sources: Yahoo! Finance