Chinese investors are cashing in their brick-and-mortar investments for pebble sized fancy color diamonds.

Grains & Coins to Riches

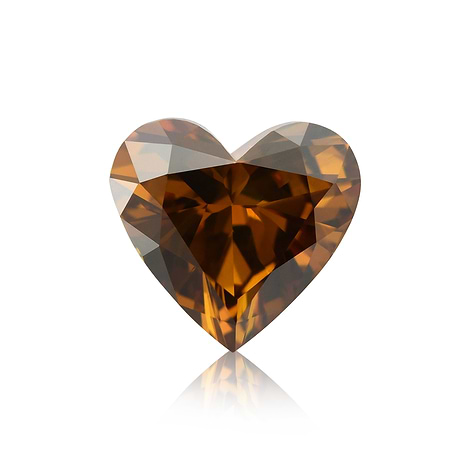

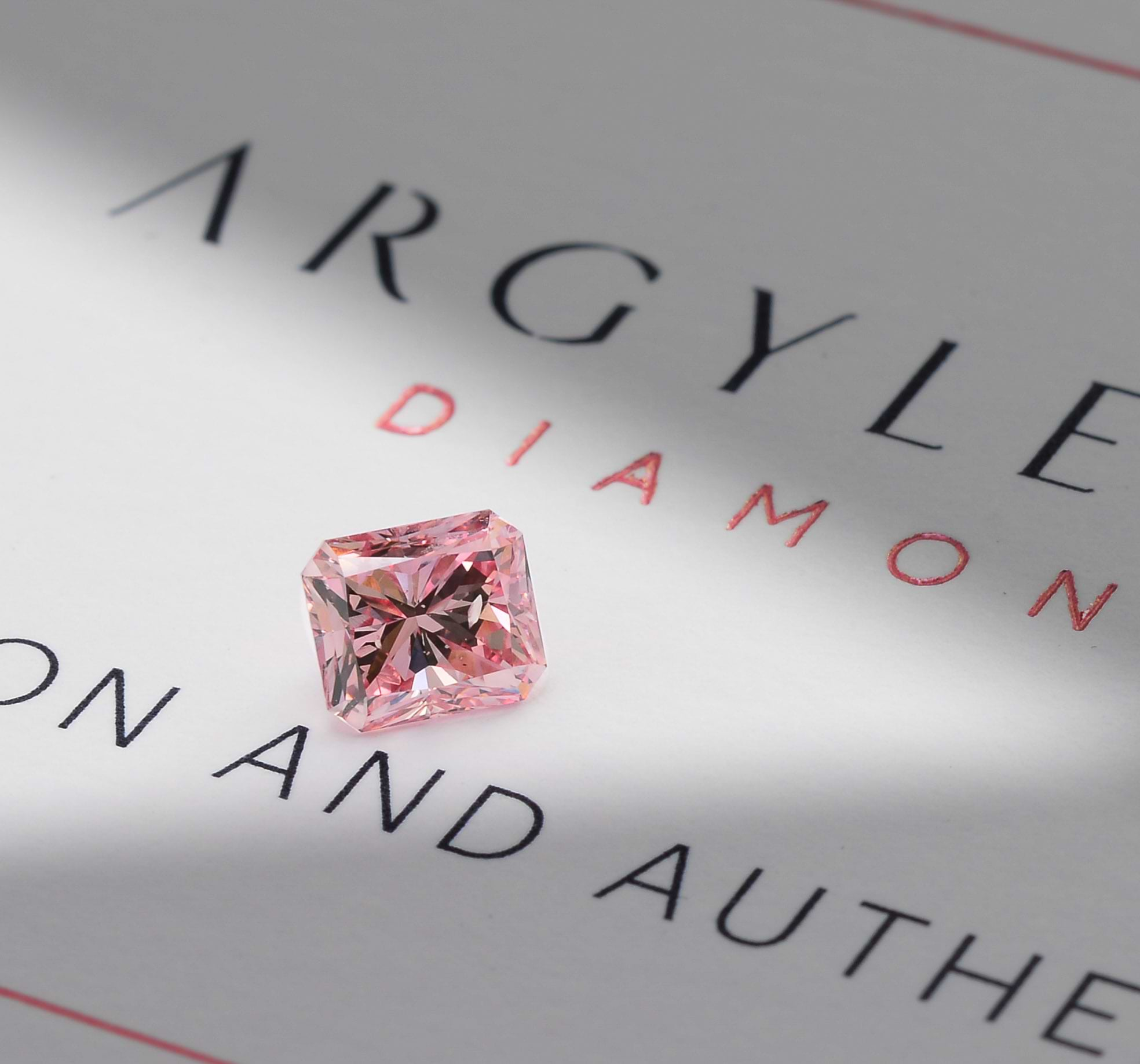

A small parcel of pebble sized fancy color diamonds

Three liters of grain and a string of coins was the property tax that the Chinese paid for hundreds of years on every 665m2 or 7,158.06 feet2. This goes all the way back to the times of the Chin dynasty in the 12th century. It only ended in 1949 when Mao Zedong took over the entire country and nationalized its assets. Ever since, the cities were relying on the sales of lands to developers for the property tax income.

China is well known for market tests, trials, and errors. The culture dictates patience and understanding before the implementation of any life changing decision on its population, even at a short term social cost to it.

Three years ago, the government decided to test a new local city property tax. Up until that point, the Chinese had been enjoying fantastic real estate-based wealth accumulation without sharing anything with their local authorities. The pilot test was applied in 2 cities, Shanghai and Chongqing. This is about to end.

How to turn a brick into a diamond?

The government has recently made the decision to take the next step, and transform the pilot test into a full-fledged law, instituting a permanent property tax throughout China. Obviously, this will be done in stages and over an extended period of time of at least 10 years in order to keep the markets from having a real estate free fall, which could potentially be worse than the 2008 global real estate collapse. They will introduce it city by city and year by year until it is fully executed everywhere. One of the major challenges with this is that there is no proper land registry, at least not computerized - it is still done the old fashioned way, on paper.

Chinese investors have already started to take steps to maintain and increase their wealth by converting their real estate investments into fancy color diamond investments. They understand how easy it would to transport their investments should there be any political instability in the country, or should the ¥ continue to increase in value as planned, their local denominated wealth will erode, not only due to inflation but due to currency devaluation of the ¥.

Fancy color diamonds are the new gold!

As described recently in Fortune magazine, diamonds are now being considered as the new gold. Diamonds are catching up to other commodities in the financial markets’ positions. Diamonds were always considered an illiquid, controlled commodity, whereas now they are much more liquid due to the advancement of technologies such as the internet. Liquidity is less of an issue today compared to only 30 years ago. We have seen the value of fancy color diamonds explode during this time. People are now more educated and significantly more information-hungry. There is a substantial increase in comfort level by individuals as much as by institutions when it comes to investing in fancy color diamonds. Demand is overtaking supply, and further increasing the gap, making valuation increase even more. There is no sign, at least not from an economic stand point, for this to slow down anytime soon.