The natural diamond niche is an ethereal brand as delicate and fragile as a child’s dream. One fiercely cold wind could strike a blow, driving it awry and turning that sweet reverie into a nightmare.

Colossal Mistake

De Beers owned Lightbox Laboratory Grown Diamonds was launched in 2018 with an ‘If you can’t beat ‘em, join ‘em” attitude, beginning innocently enough it seemed. They thought by offering undercut pricing on LGD loose stones it would enhance the value of real diamonds.

Then, this summer, with zero fanfare, they expanded their offerings to include engagement rings. Neither press release nor prior notice was given to Sightholders. But according to a report published in JCKOnline June 22, 20023, “Lightbox told JCK: “We have not held to a fixed price for this test. We are using this period to better understand consumer reaction to different propositions.””

LEIBISH Extraordinary Oval Fancy Deep Orangy Yellow Halo Diamond Ring

Irreversible Damage

The article’s author Rob Bates added, “This wouldn’t be a big deal if it wasn’t De Beers. But it is. And symbolically this looks terrible. What kind of message does it send, especially to jewelers who are on the fence about lab-grown (and some still are, especially overseas)? Yes, companies like De Beers should occasionally take risks, but there’s a reason big ships move slower than small ones. If they make a mistake, they create a lot more damage.”

Early Predictions

I warned about this outcome years ago, saying De Beers’ seal of approval for LGDs gave a stamp of authority to fake copies of real diamonds which would undermine the value of the diamond brand.

Extraordinary Afghan Emerald and Diamond Side Stone Ring

Not As Expected

De Beers branding policy has since devolved into a nightmare, hurting their loyal customers who buy De Beers rough. One has to ask--who borrows money at 10 % while their diamond stock also devalues 10% per annum? It wipes out the capital base in short notice.

Likewise damage is being done to De Beers own balance sheets due to their insane miscalculation over the Lightbox debacle. Unfortunately it gave the ultimate seal of legitimacy to the LGD which in turn hit rough diamond sales with a vengeance.

LEIBISH Multi-Color Diamond Cluster Couture Ring

De Beers image took a big hit, which emboldened Botswana to force De Beers to yield 50% of Botswana’s mined rough to them. Botswana De Beers stock has tanked 35% this year—and is continuing its downward trajectory. Given its regrettable direction, De Beers is destined to lose complete control over the Sight distribution within 5 years. It is projected to be taken over completely by Botswana in a new open ended forum.

The Genie is Out

LGD is like a diaphanous spirit having escaped from its genie’s bottle with plans to take over heaven and earth – while ultimately destroying its own creators.

According to diamond industry analyst Edahn Golan, an astonishing 50% of all diamond sales in the US today are from LGD. I get it. I understand that retailers are pulling in 200 % profit on LGD while barely making 15 on real diamonds.

LEIBISH Burmese Marquise Ruby and Heart Diamond 3 Stone Halo Ring

Our Stability

The flip side of this story is that Leibish is not hurt at all from the LGD surge, since we sell natural fancy color diamonds and fine gemstones both loose and set in jewelry.

Overruling all, the most important issue remains that LGD is declared an imitation of a real diamond - a valueless item, worth less than the cost of its paper certificate.

Educate the Consumer

With LGDs massive marketing push, consumers have the misguided impression that they are getting an actual diamond that is more ethically produced and environmentally friendly, yet cheaper. This statement is not correct – LGD are not eco friendly and not sutenaeble

What they’re not being told is that the stone is a worthless fraud.

Think of this---a man gives an LGD engagement ring to his fiancée who assumes her ring symbolizes their glowing future and enduring love. Some years down the road it becomes apparent that the diamond is a fake---and this taints the original promises of everlasting love. Could their love then be worthless too? She may want to upgrade to a real natural diamond.A lot of promoters are claiming that LGDs are indistinguishable from real diamonds. That may be true to an untrained eye—but they’ll never hold a candle to legitimate earth-mined treasures. And of course, the industry has already developed tools to make a positive separation between LGDs and natural stones. That’s important for both the consumer and retailers.

But the bigger issue here – the one which causes my voice to rise again and again is the social and economic damage being perpetrated. Our industry employs about 10 million people worldwide starting with the poorest diamond diggers in Africa. Some of these workers earn just $1-dollar a day for their back breaking labor. There are roughly 1 million of them.

And there are another 1.5 million polishers and industry workers in India. Do you hear anyone talking about them?

All the flowery babble about “saving our environment” by switching to LGD--It’s simply not true. Here’s what you haven’t heard. Founder of ADA Diamonds Jason Payne has said “the most efficient” growers consume 250 KW per carat, which is equal to amount of electricity an average U.S. household uses in 8.7 days. That’s equivalent to the electricity used to fully charge a Tesla 2 ½ times. Shockingly he says most labs use about 750 KW to grow a diamond.

In stark contrast, JCK reports that the Argyle mine used just 7 KW of energy to recover a one carat diamond. In complex mining procedures, some mines may use up to 50 KW per carat.

This lab grown sector turns its back on the poorest most vulnerable people in the industry. With less work, or worse--no work, how will they earn a living and provide for their families?

Nothing Beats the Real Thing

The argument that the LGD are looking identical to a real diamond also misleading. I’ve seen a few convincing replicas of the legendary Mona Lisa in my day.

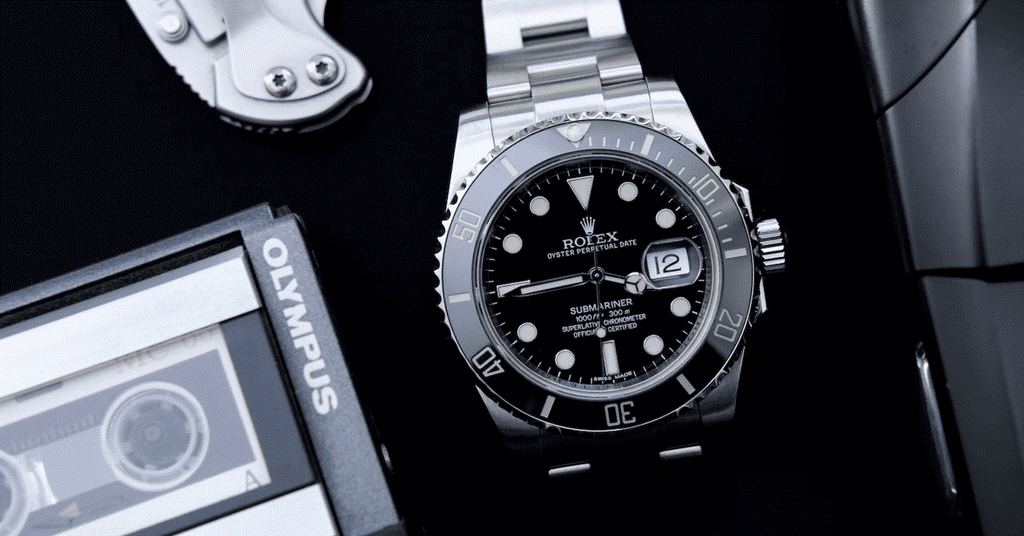

Frankly, some of them look better than the original by Leonardo da Vinci. And you know what? 95 %of buyers cannot differentiate a fake a real Rolex Submariner from a fake. So what?

Did you notice yet another watch brand jumping on the bandwagon by embracing the use of LGD? I’m talking about pricey timepieces retailing between $200 -- $500K too. The magazine Watch Pro headlined, Heuer’s New Watch Pushes Lab-Grown Diamonds to Their Limit. But is this really a match made in timepiece heaven?

But there’s more to look at Swithinbank posits. “But are lab-grown diamonds a girl’s best friend, he wonders. “Are they forever? I don’t see it.”

He has a point. “Instead, I see a gross romance deficit,” Swithinbank claims. “And if I were a brand pedaling theses stones that would be a concern.”

He offers up an even more ominous prospect. “As more watch brands embrace the alchemy of diamonds grown in a laboratory, Swithinbank says the value and romance deficit in a man-made gemstone will have luxury buyers digging in the dirt.” There you have it, Incising perspectives on the real and the fake side of our trade.

The real deal wins out every time with its indisputable value.

We all want a real relationship—we want real jewelry, real commitment, Fakes may look great at first glance, but they can never deliver that lifelong joy to make us satisfied forever.

Let’s recall the lyrics from Diamonds Are Forever, (James Bond)

''Diamonds never lie to me, for when love's gone, they'll luster on'' - SHIRLEY BASSEY

LEIBISH Fancy Intense Yellow Radiant 3 Stones Diamond Ring

LEIBISH Fancy Intense Yellow Radiant 3 Stones Diamond Ring