Putting one’s money to good use by means of an investment has been a way of spending money wisely for decades. Traditionally, individuals looking to increase their fortune turn to the stock market, real estate, and other business opportunities that seem promising.

The common denominator between these ventures is that they all have potential to provide turnover. People want to see their money earn more money, this is why the investment community is always on the lookout for good opportunities. However, history has proven that every investment has a risk and even the quickest investments can turn sour. This is why more and more investors are looking elsewhere for investment opportunities, and are thinking more outside of the box. There is a large segment looking for the right alternative investments. Investing in diamonds, particularly color diamonds, is nothing new but taking it seriously is something that has become more of a phenomenon as of late. Having said that, color diamond investments are not for everyone and those who choose to go down this path need to do it right. Here are some tips that will help guide you down the diamond-investing road and help you get the most for your buck.

Long-Term Goals

Before we go any further it is crucial to point out that if you want to see your diamonds appreciate, you must have long-term goals. This is not about buying one day and selling the next; not in the least bit. What’s great about having this kind of long-term investment is that it comes in the form of a beautiful gem. You can have it set in a piece of jewelry and worn, or displayed in a box. It doesn’t have to be some boring document that is of no use until it is traded for money. Look towards diamond investments for a minimum of 5-10 years.

Manage Your Money

Part of having long-term investment goals means knowing that you will not have that money back, or any extra it might earn you, for quite some time. Therefore, plan accordingly, and be certain you can survive without it while you enjoy your investment. Also, use the time to familiarize yourself with the diamond world. Read what people are interested in, see what is selling, and try to pay attention to what the diamond market has to offer.

Investing in Leibish Diamonds

Purchase from Dependable Dealers

One of the basic elements of a good investment is buying low and selling high. Therefore, you absolutely must work together with someone familiar with the diamond trade you feel you can trust. Read reviews, speak to your friends, and find the right company to team up with.

Selling diamonds is not impossible, but isn’t easy. It isn’t a publicly traded asset that can be done simply by clicking your mouse. You need someone who has a large list of diamond buyers. As it is a luxury item, the buyer needs to feel they can trust you. When the time comes to make an exit, you want to know you have someone who will take it off your hands and help sell it off. Aside from being reassured that you have bought a genuine treasure, it is important to purchase diamonds from dependable diamond dealers in order to ensure they won’t leave you out in the cold.

Patience Pays Off

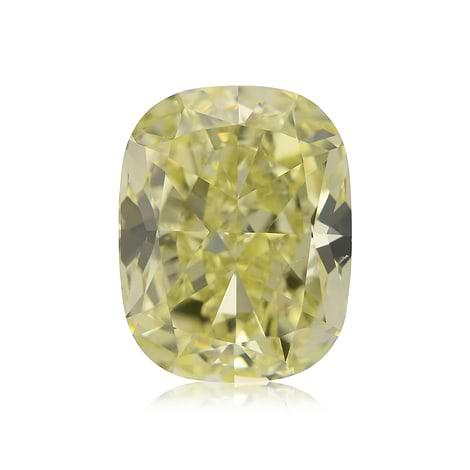

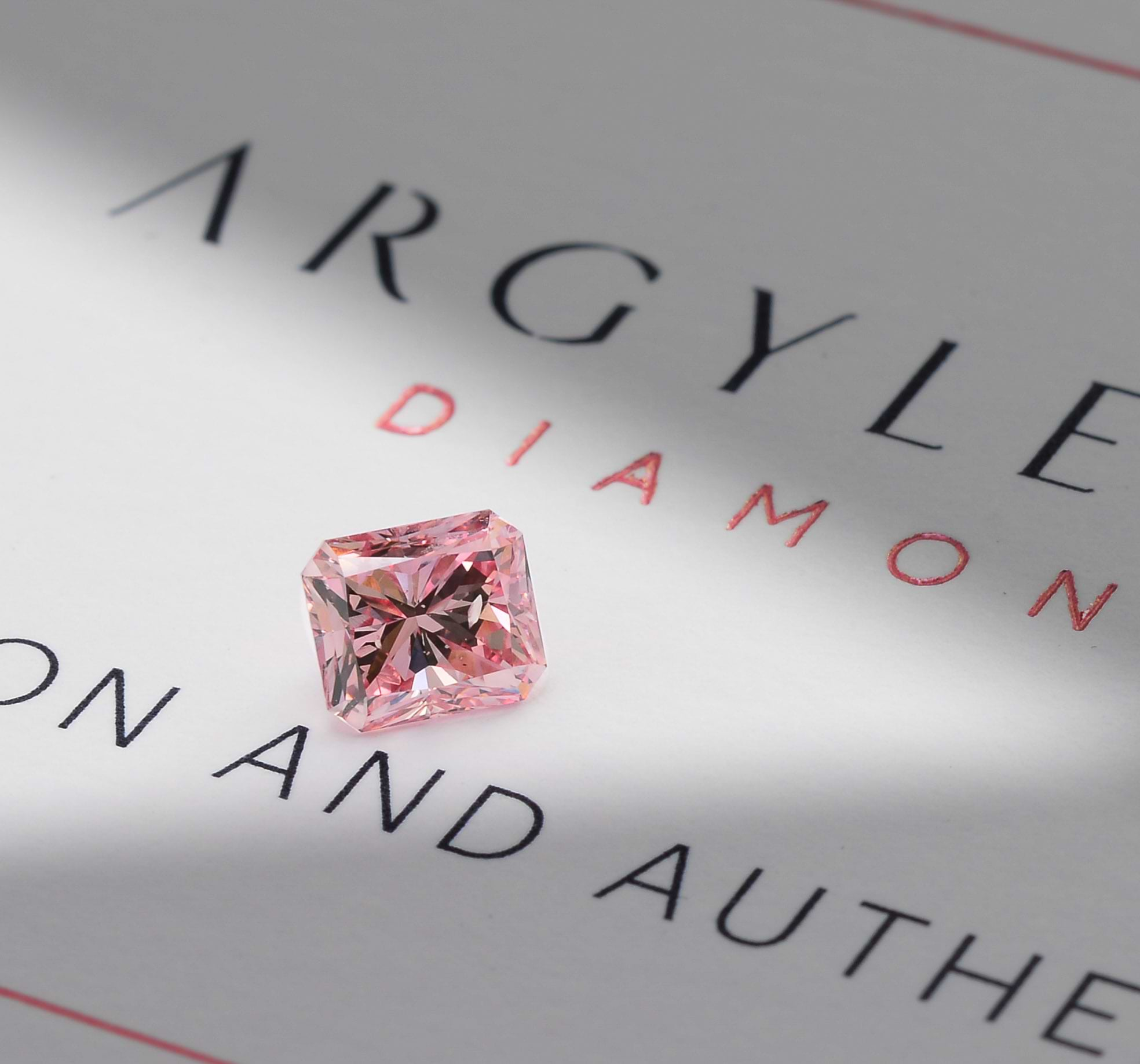

We have already mentioned that diamond investments are long-term. However, all of that patience does pay off. Try selling your rare pink diamond five years after you bought it and you will see it will be worth your while. Wait ten years, enjoy your gem, and watch as it appreciates over time. We know the diamond supply, especially the color diamond one, is dwindling and we know that the demand for them is growing. The value of these stones won’t change dramatically over a couple of years but they most likely will over a decade.

To summarize, you need to see the big picture before you become invested and realize that this is not an ordinary investment. Certain pink, yellow, and blue diamonds can make ideal investment pieces, as they are rare, in high demand, or both. Other colors are not as ideal and will be slower and less lucrative investments as a whole. However, with mines predicted to close in the next decade or so, including the famous Argyle mine, home of the most famous pink diamonds, it is quite feasible that some stones’ value will skyrocket over the next few years. In addition, this is a remarkable specimen that can serve as a special heirloom and can remain in the family for generations if you decide not to sell after all.

Speak to one of our diamond experts.