This world can be broken down into those capable of making educated and informed decisions about investments and those whose "now" is a never ending tomorrow. When it comes to diamond investments, there really isn't any time to stall. For some time now, the word on the street was that the famous Argyle mine would close its doors and its prestigious diamond production by 2020, and we are actually starting to see signs that this will indeed happen.

We already know that the size and quantity of the argyle stones have been diminishing over the years, as was shown in the Argyle Diamond Phenomenon. The mine could invest another $2 billion and move further underground, but most of Rio Tinto's funds are tied up in Iron Ore whose prices fell to its lowest point in six years.

Perhaps this is one of the reasons the demand for these lavish items continues to increase, which causes the prices to skyrocket, but it also indicates that the opportunities to own these rare specimens are gradually growing smaller and smaller. Therefore, the time to invest in an Argyle diamond is now.

The Argyle Mine

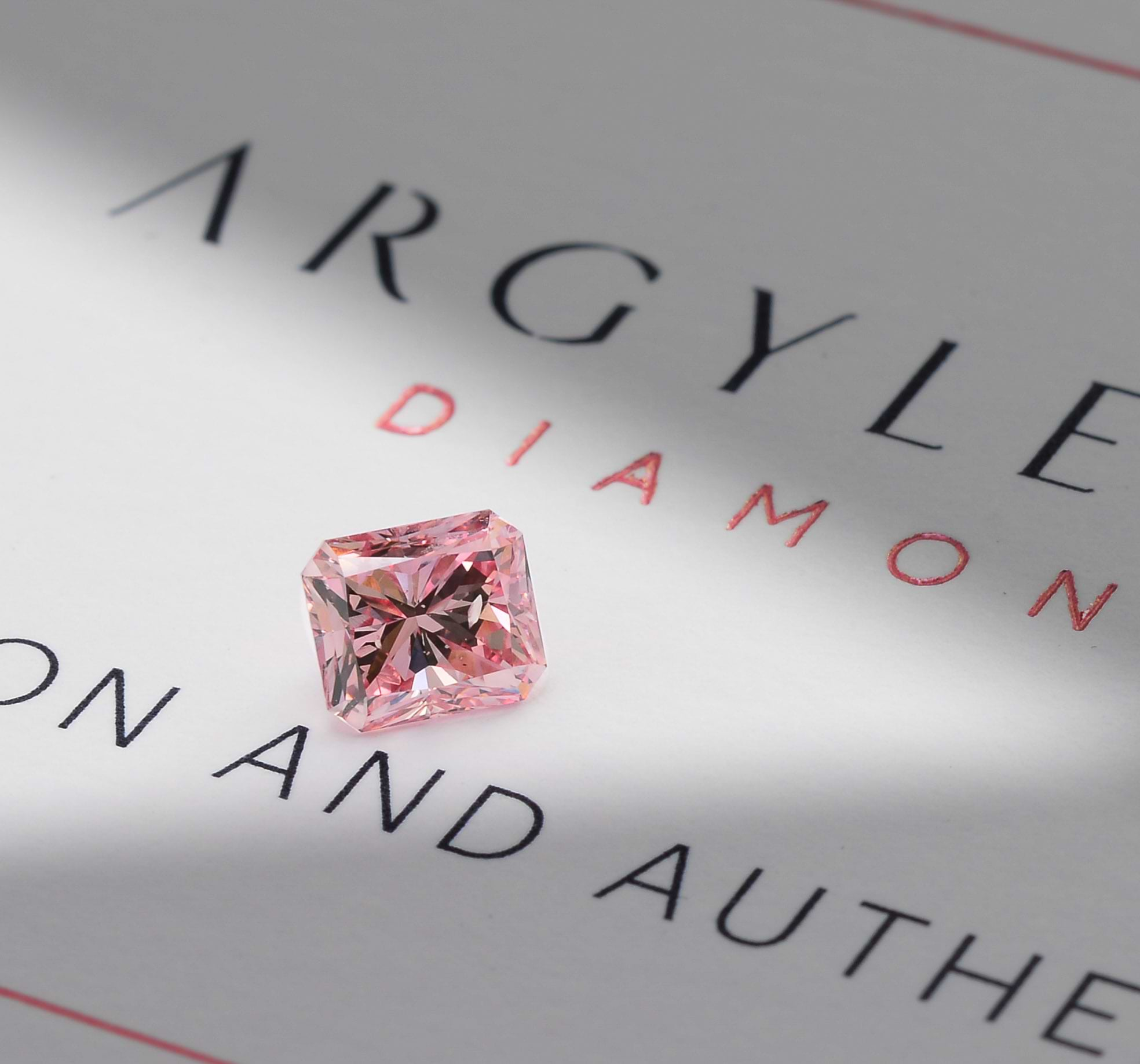

Located in the Kimberley region of Western Australia, the Argyle mine is the leading source of natural pink diamonds worldwide. In fact, it is responsible for 90% of the world's pink diamond production. Furthermore, it is known to produce pink diamonds with a special bubble gum pink hue, unlike any other pink diamond found in various other locations around the globe. Though it is mainly known for its pink, and sometimes red diamonds, 80% of the mine's diamonds are actually brown. Approximately 16% of the mine's diamond production, since it opened its doors and until 2013, were yellow, while 2% were gray, and only 1% of all those 750 million carats worth of diamonds were pink. Yet without that 1%, the world's pink diamond supply would be cut back by nine tenths, causing the already steep prices to soar. However, the more that times goes on, the more the Argyle's prediction in 2013 of the mine shutting its doors in 2020 seems to be transforming into a reality.

The Argyle Tender

The annual Argyle Tender is a prestigious and exclusive event featuring the esteemed company's most valuable stones. These rare stones are offered to the cream of the crop in the diamond world. Only they are free to bid on the various unique stones; but there are only so many winners since only one single bid may be submitted per stone, of which the highest bid wins. It is for this reason that each attendee must have a very knowledgeable understanding of the market in order to still be able to offer the stone to his clients for a competitive price.

The annual Argyle diamond Tender featuring the mine's finest stones mined each year, recently closed its bids on the 2015 Tender and announced that Leibish won 26 of the 65 stones offered. Many interested in finding out more information about these stones already contacted the company before the stones even arrived to the office.

Argyle Diamonds Over the Years

It is completely normal for an item to increase in price as the years go by, especially if it is a low supply product with a high demand. What is less common, though, is for said item to triple in price in a such a short time span. This is precisely what has occurred over the course of 2010-2014, when the annual Argyle Tender saw a tripling of its selling prices from previous years. One would think that the merchandise has improved and that Argyle has been managing to produce stones that make diamonds from previous tenders pale in comparison but the reality is that percentage-wise the diamonds are actually smaller, of lesser quality, and boast lower color intensity levels than Tender stones from earlier years.

Conclusion

With so many factors involved, including the world economy and the general decline in the price of diamonds, Rio Tinto, the Argyle Mine mogul, is faced with many challenges as the inevitable closure of the once prosperous mine looms ahead. As fate would have it, the primary pink diamond supplier appears to be looking at its termination just as its most powerful product, the pink diamond, is reaching its peak in terms of popularity and demand. With such a high demand for the desirable pink stone and a diminishing stock, it would be wisest to act now if a pink diamond is on your diamond bucket list, or any other type of bucket list for that matter.