In such a diverse economy where market prices can instantly change from one moment to another, identifying stable investment opportunities is crucial. Since infinite stability is impossible and can't actually exist, an initial amount of research is required before an investment is made to ensure the fund is headed in the right direction.

Investment bankers, financial institutions, and business analysts who have investigated colored diamonds as an investment class are often surprised by their results. So much so that in today's versatile market specific stones are considered by many as one of the strongest investment opportunities around. Colored diamonds exhibit investment characteristics that other class's can only dream about emulating.

LEIBISH has published many articles on the subject of price performance over the past 30 years. However, we decided to list 10 alternative reasons why colored diamonds are considered such strong and wise investments. #

1. WELL ESTABLISHED

Fancy colored diamonds are internationally recognized, well established goods. They have been collected and traded by royalty for hundreds of years and have only recently become available to the general public.

The prices have continued to increase in a steady, upward trend over the past 30 years and longer.

2. PORTABILITY

Diamonds are small, they weigh next to nothing and they are extremely portable. Therefore, large amounts can easily be transported and concealed in emergency situations.

Your entire portfolio can be stored in your pocket, set in a piece of jewelry, or secured in a safe deposit box.

3. LONG TERM GROWTH

Even just a little research proves that over the past 30 years, the price appreciation of natural fancy colored diamonds has dominated the market. Auctions results prove the strength of colored diamonds in today's market, not to mention that they have repeatedly broken auction house records for the highest price per carat ever paid at auction for a diamond or jewel.

|

The price appreciation of Fancy Intense Pink Diamonds (1-2 ct) between the years 1995 - 2013 compared to other major investments |

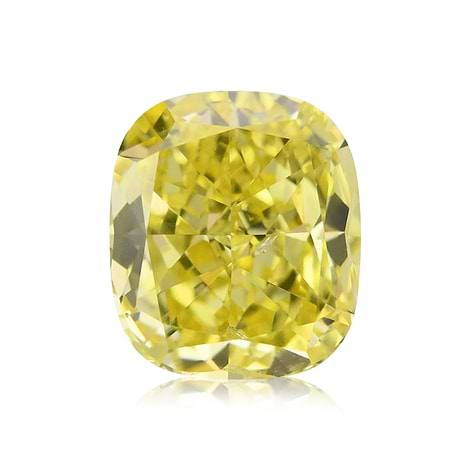

4. MULTI-FUNCTION ASSET CLASS

They possess multiple functions as an asset. For example, one can purchase for investment purposes a 5.00-carat, Fancy Intense Yellow diamond, set it in a ring and present it to his wife. The fact that she uses the diamond and derives pleasure from her jewel over time does not detract from the value in any way.

|

Leibish Prosperity Pink Diamond Engagement Ring |

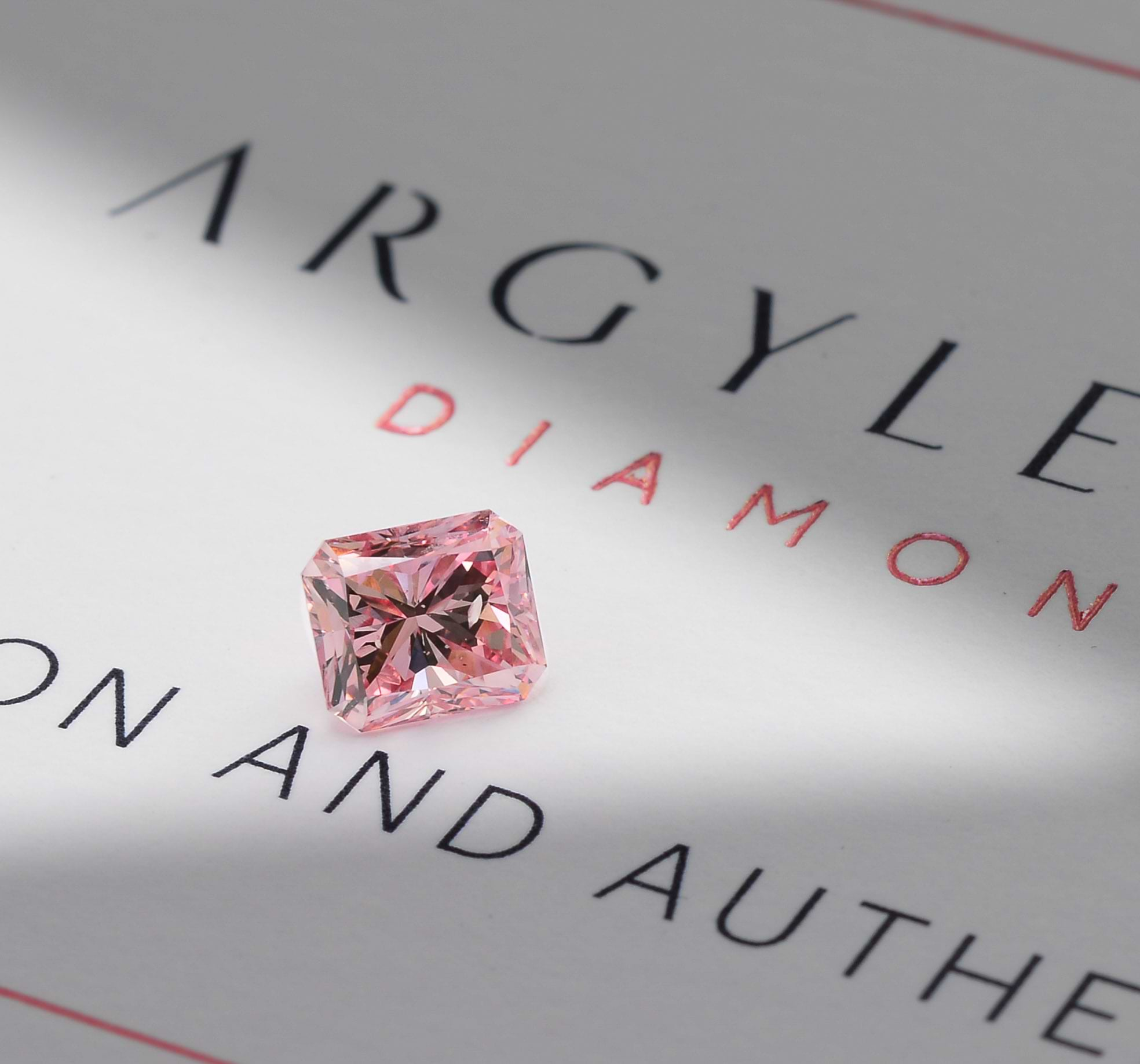

5. VALUE RETENTION

Contrary to colorless stones, fancy colored diamonds have no fixed price. Their market value is determined by prices paid in the auction houses. The rarity of the colors found has everything to do with the prices and supply is not growing. Even the Argyle mine, which produces the world's most valuable pink diamonds, has publically announced their suspected closure by 2018.

6. VALUE

An asset's value is determined according to its supply and demand. As the rarest gemstones on earth, of which only 0.01% of natural diamonds are fancy colors, their supply is quite limited. Moreover, many famous Hollywood movie stars have been seen adorning their colored diamond jewelry in public, therefore substantially increasing the market demand for these stones.

7. DURABILITY

Colored diamonds are extremely durable. In fact, as the hardest element found, after having been created in unimaginable conditions deep beyond the surface of the earth, diamonds can withstand just about any environmental situation.

8. RARITY

Colored diamonds are one of the rarest commodities in the world. They are found in only a handful of diamond mines in the world and even then only appear as a small percentage of full production. Some colors, Fancy Intense Violet for example, are considered so rare that most companies will never actually see its shade.

9. PRIVACY

They are a highly private asset. They can be easily stored for safe keeping without ever sharing the information publically. They require no reporting for tax purposes, and can be savored on a daily basis.

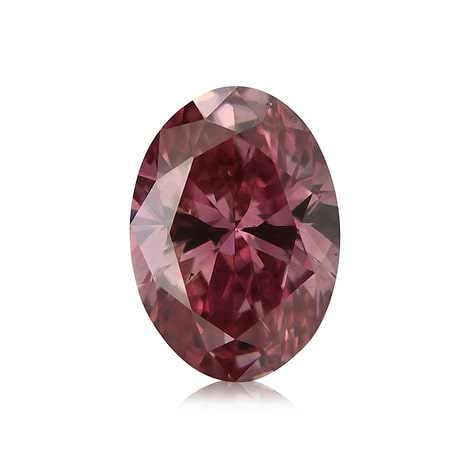

10. ABSOLUTELY BREATH TAKING

It is no secret that fancy colored diamonds are simply breathtaking to look at. Regardless of who you are or what line of work you are involved in, everyone is absolutely mesmerized by the brilliance of a colored stone. As a direct result of their beauty and unforeseen rarity, colored diamonds are today considered exceptional investment options.

|

Pink, Green, Blue, Yellow Collection |

As technology advances and mining operations improve, more and more diamonds are extracted from the earth. However, fancy colored diamonds will not be around forever. Volatility in any market tends to create activity as we see in today's commodities and investors aim to grow and color their portfolios in order to secure their future.

Consider coloring your portfolio and have a look through the colored diamonds in our collection.

Read more about investing in diamonds.

Contributor: Benji Margolese